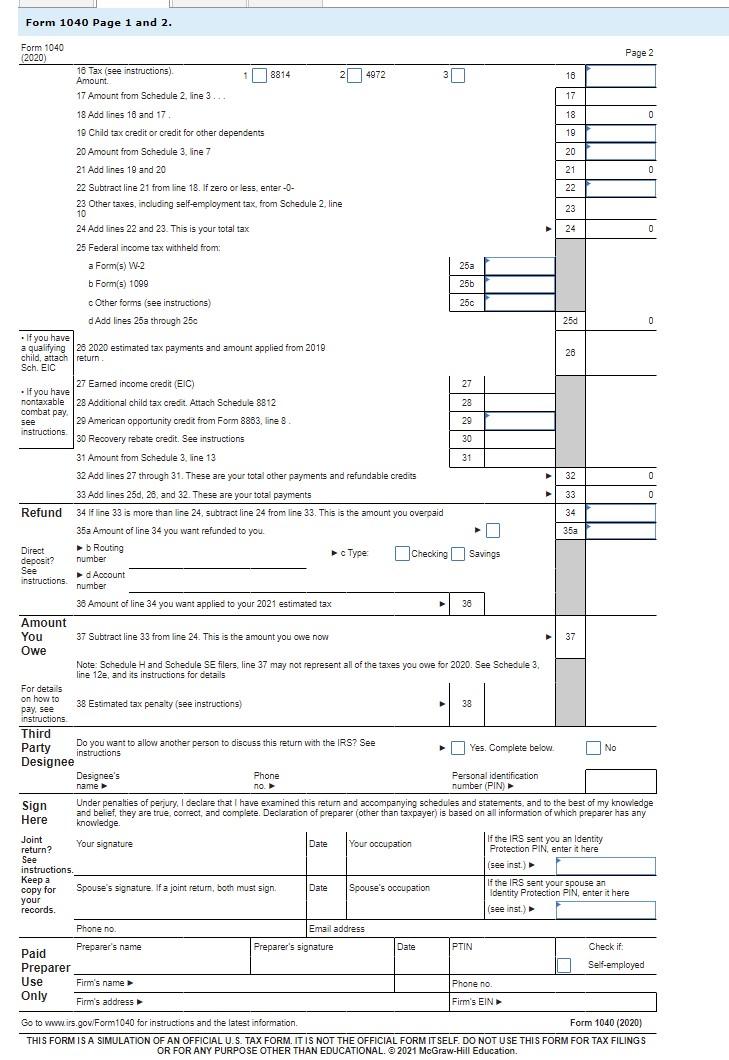

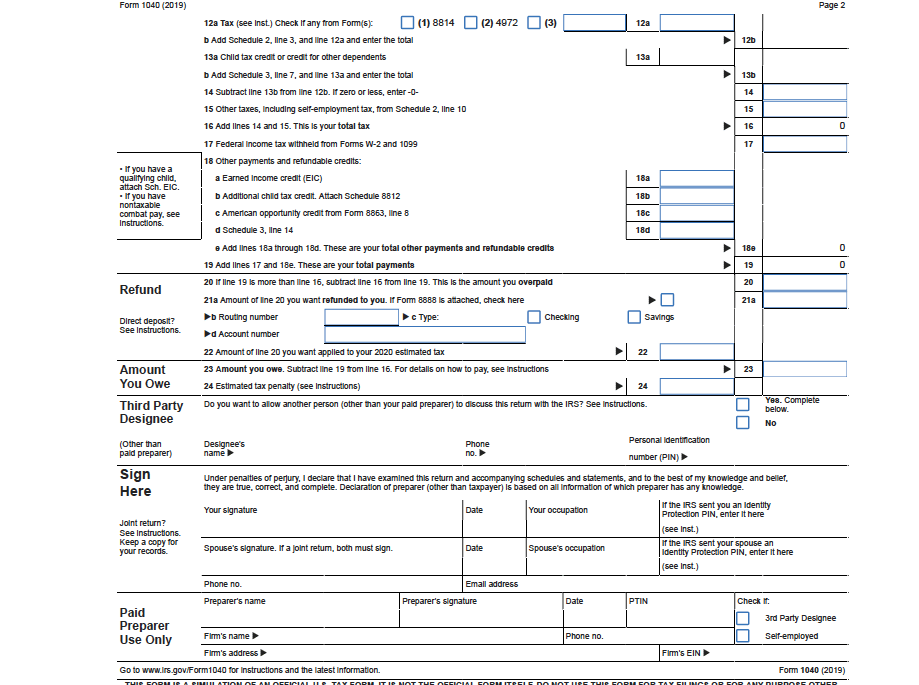

Tax Form 8814 And 4972 - What is irs form 4972 used for? If you have a child with unearned income, such as dividend income or interest, your. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution. The form is used to take advantage of special. Screen in the income folder to complete form 4972. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including.

Screen in the income folder to complete form 4972. If you have a child with unearned income, such as dividend income or interest, your. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution. What is irs form 4972 used for? To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including. The form is used to take advantage of special.