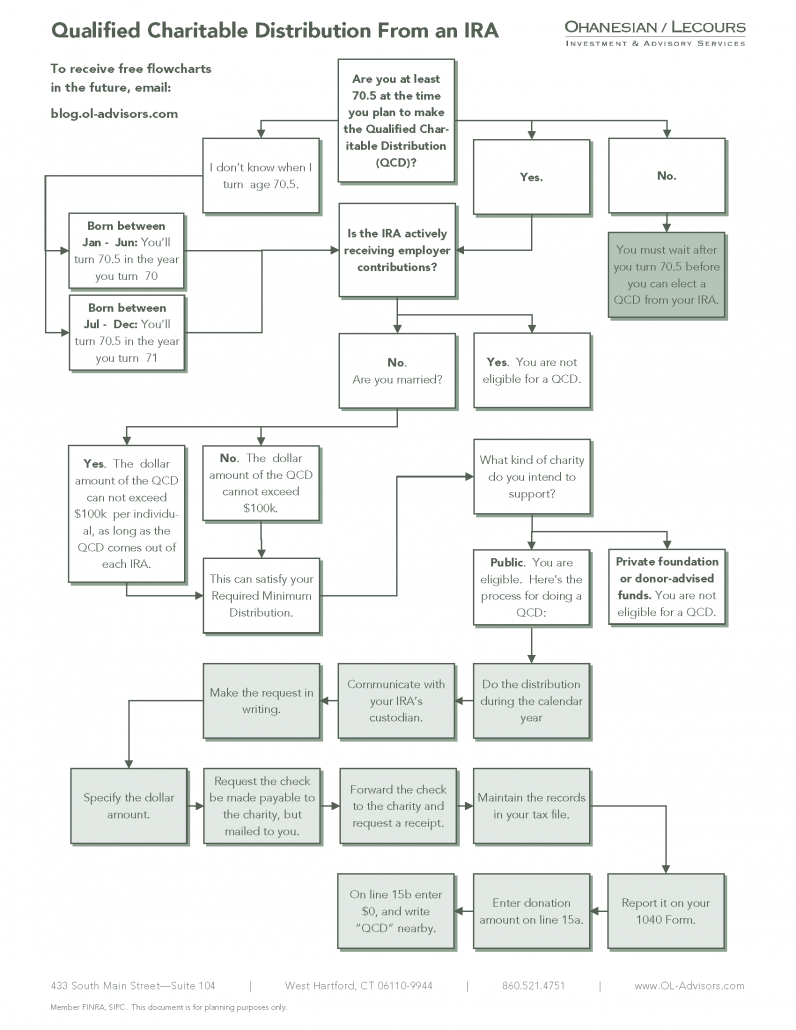

Qualified Charitable Distribution Form - How do i take a qualified charitable distribution (qcd)? Qcds are direct transfers of funds from your ira to a qualified charity that can satisfy your rmds and reduce your taxable income. You can sell shares from your vanguard.

You can sell shares from your vanguard. How do i take a qualified charitable distribution (qcd)? Qcds are direct transfers of funds from your ira to a qualified charity that can satisfy your rmds and reduce your taxable income.