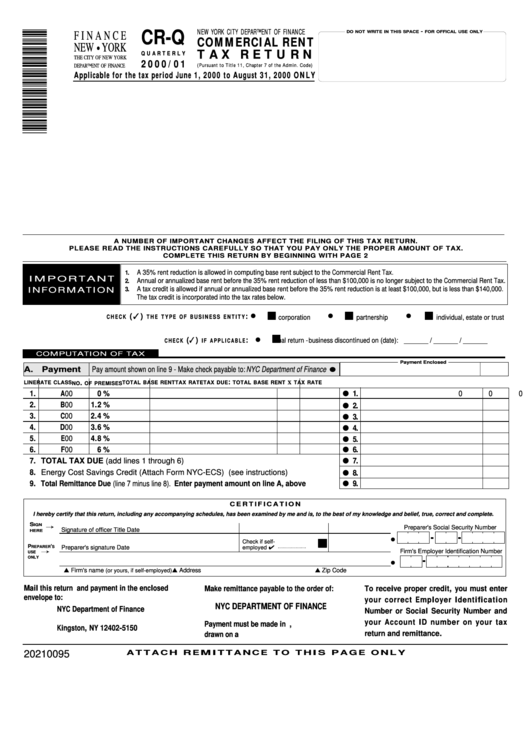

Nyc Commercial Rent Tax Form - Web the commercial rent tax is charged to tenants who occupy a property for commercial activity in manhattan below. For more information log on to nyc.gov/eservices. Web taxpayers whose annual or annualized base rent before the 35% rent reduction is less than $100,000 for the tax period 6/1/2000. If you are filing on paper, download the current tax forms as. Pay or file taxes through e services. Web nyc commercial rent tax returns are required for taxpayers whose annualized gross rent payment exceeds. Web the commercial rent tax (crt) applies to tenants who occupy or use a property in manhattan, south of 96th street for any. Commercial rent tax (crt) reduction details.

Web the commercial rent tax is charged to tenants who occupy a property for commercial activity in manhattan below. Web taxpayers whose annual or annualized base rent before the 35% rent reduction is less than $100,000 for the tax period 6/1/2000. Web the commercial rent tax (crt) applies to tenants who occupy or use a property in manhattan, south of 96th street for any. Commercial rent tax (crt) reduction details. If you are filing on paper, download the current tax forms as. For more information log on to nyc.gov/eservices. Web nyc commercial rent tax returns are required for taxpayers whose annualized gross rent payment exceeds. Pay or file taxes through e services.