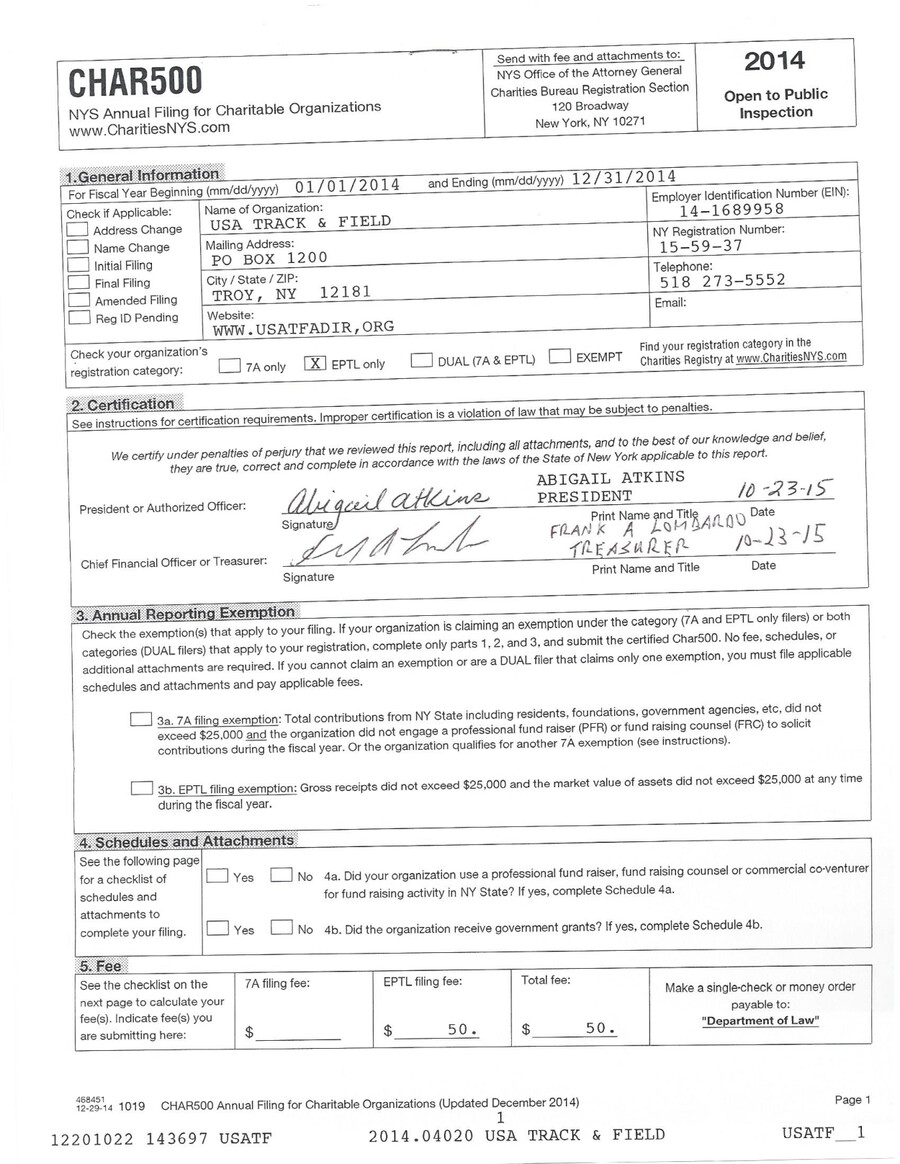

Ny Char500 Form - Send with fee and attachments to: Web all charities that have a december 31 fiscal year end must file their 2022 annual reports (char500) online with the office of the. Web to register, unregistered organizations should use form char410 and the instructions to that form. Web char500 annual filing for charitable organizations (updated january 2022) *the exempt category refers to an. 19, 2022, filers will be required to submit form char500. Web as per the new york attorney general’s office, effective monday, sept. Nys annual filing for charitable organizations www.charitiesnys.com. Web nys annual filing for charitable organizations char500 is now online.

Web char500 annual filing for charitable organizations (updated january 2022) *the exempt category refers to an. Web to register, unregistered organizations should use form char410 and the instructions to that form. Nys annual filing for charitable organizations www.charitiesnys.com. Web as per the new york attorney general’s office, effective monday, sept. 19, 2022, filers will be required to submit form char500. Send with fee and attachments to: Web nys annual filing for charitable organizations char500 is now online. Web all charities that have a december 31 fiscal year end must file their 2022 annual reports (char500) online with the office of the.