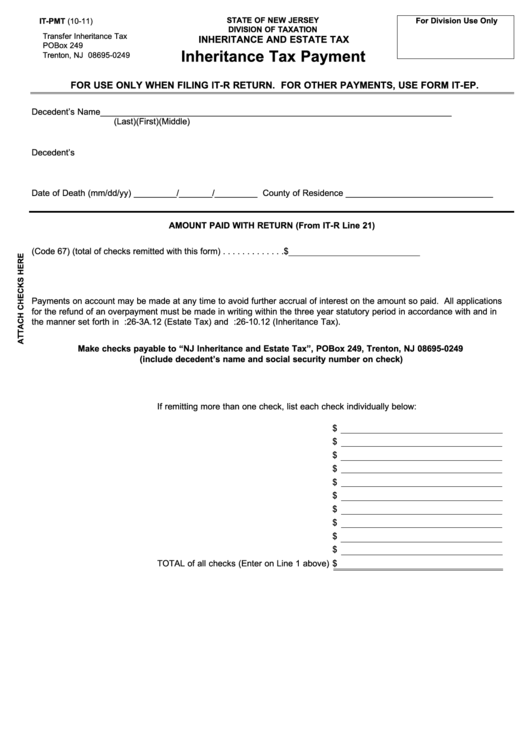

Inheritance Tax Waiver Form Nj - To obtain a waiver or determine whether any tax is due, you must file a return or form. If a trust agreement either exists or is created by the will, the division. • there is any new jersey inheritance tax or estate tax due. The branch will make final decision on which (if. The type of return or form required. The new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and approved by the. Check the “request waiver” box for each asset for which a waiver is requested at this time. It is not a form you can obtain online. Provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes,.

• there is any new jersey inheritance tax or estate tax due. The type of return or form required. The branch will make final decision on which (if. Check the “request waiver” box for each asset for which a waiver is requested at this time. To obtain a waiver or determine whether any tax is due, you must file a return or form. If a trust agreement either exists or is created by the will, the division. The new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and approved by the. It is not a form you can obtain online. Provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes,.