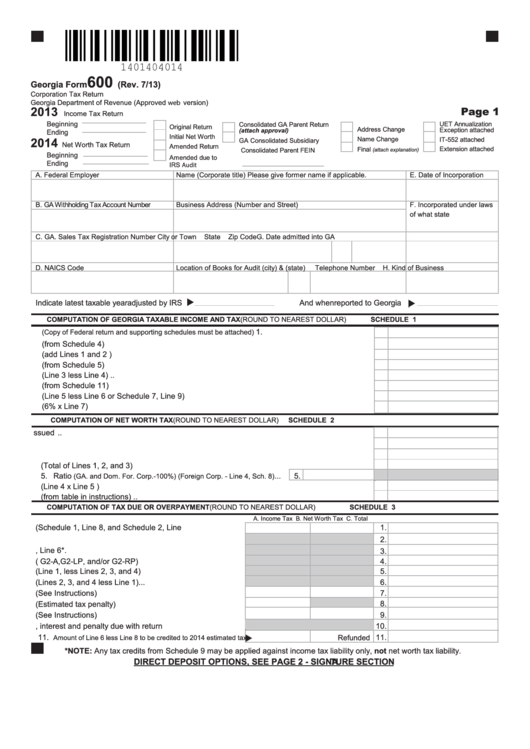

Ga Form 600S - Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Complete, save and print the form online using your browser. Corporate income tax and net worth tax returns (form 600s) are due on or before the 15th day of the 3rd month. Georgia department of revenue save form. File form 600s and pay the tax electronically. Georgia form 600s/2020 computation of tax due or overpayment (round to nearest dollar) schedule 4 11. As defined in the income tax laws of georgia,. Print blank form > georgia department of revenue. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Corporate income and net worth.

Georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Georgia form 600s/2020 computation of tax due or overpayment (round to nearest dollar) schedule 4 11. Complete, save and print the form online using your browser. Print blank form > georgia department of revenue. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. As defined in the income tax laws of georgia,. File form 600s and pay the tax electronically. Corporate income tax and net worth tax returns (form 600s) are due on or before the 15th day of the 3rd month. Corporate income and net worth. Georgia department of revenue save form.