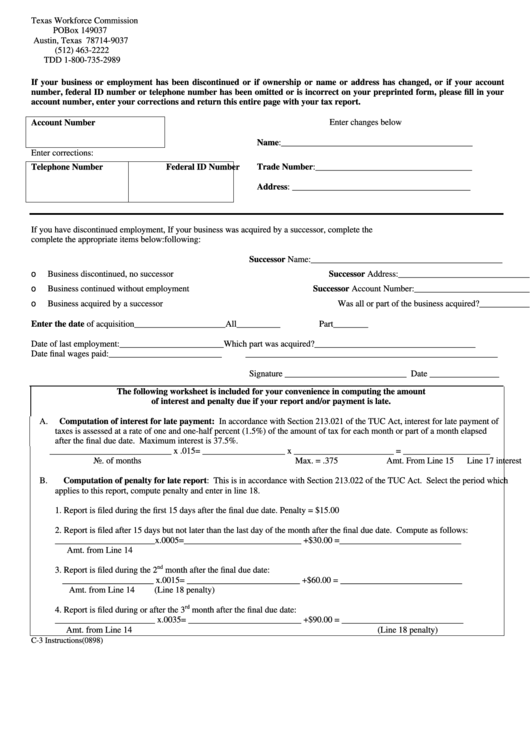

Form C-3 Texas - In this section, you can find the different employer’s quarterly wage report filing options. Tax due (item 15) computation. Options include unemployment tax services. Information is also provided for due date adjustments for holidays and weekends. Learn about due dates for wage reports and tax payments. Texas unemployment compensation act (tuca) learn whose wages to report, which wages and benefits are taxable, and how much tax is due.

Options include unemployment tax services. In this section, you can find the different employer’s quarterly wage report filing options. Texas unemployment compensation act (tuca) learn whose wages to report, which wages and benefits are taxable, and how much tax is due. Information is also provided for due date adjustments for holidays and weekends. Learn about due dates for wage reports and tax payments. Tax due (item 15) computation.