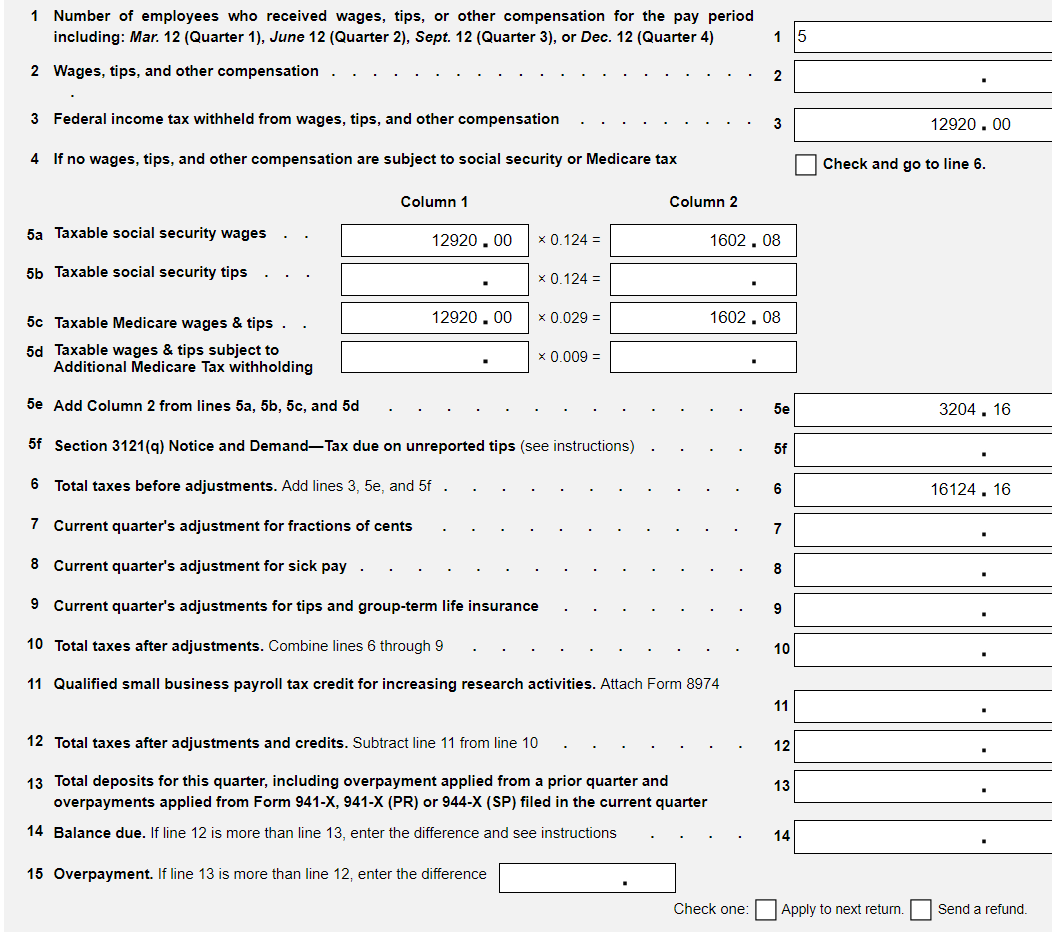

Form 941 For 2019 - Form 941, employer's quarterly federal tax return, reports wage withholding to the irs for income taxes, the employees' share. Employers use form 941 to: Employer's quarterly federal tax return for 2022. About form 941, employer's quarterly federal tax return. For employers who withhold taxes from employee's paychecks or who must pay. Report income taxes, social security tax, or medicare.

Employers use form 941 to: For employers who withhold taxes from employee's paychecks or who must pay. Report income taxes, social security tax, or medicare. Form 941, employer's quarterly federal tax return, reports wage withholding to the irs for income taxes, the employees' share. Employer's quarterly federal tax return for 2022. About form 941, employer's quarterly federal tax return.