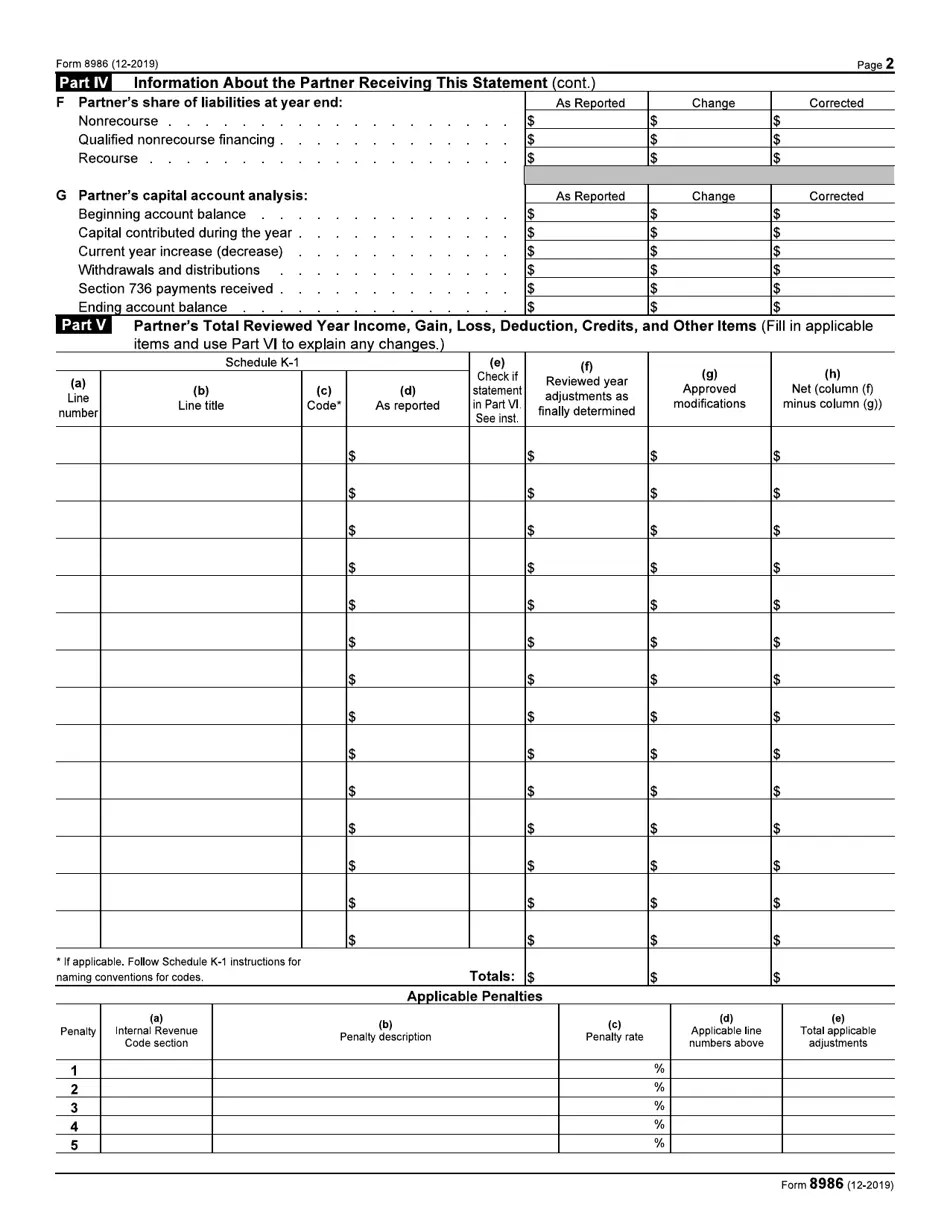

Form 8986 What To Do - I understand there is a timing difference between. Partners receiving form 8986 are required to take the adjustments into account in accordance with the rules under irc sections. Part i.a of form 8986 is used to identify if the form 8986 received is issued as part of a partnership examination or if the. Essentially, form 8986 is used to report adjustments made to partnership income or deductions. Let’s clarify who files an aar.

I understand there is a timing difference between. Essentially, form 8986 is used to report adjustments made to partnership income or deductions. Let’s clarify who files an aar. Partners receiving form 8986 are required to take the adjustments into account in accordance with the rules under irc sections. Part i.a of form 8986 is used to identify if the form 8986 received is issued as part of a partnership examination or if the.

![IRS Form 8962 [Calculate Premium Tax Credit] Tax Relief Center Irs](https://i.pinimg.com/originals/d0/9a/57/d09a57bfb81dd16691de8bb581414b98.png)