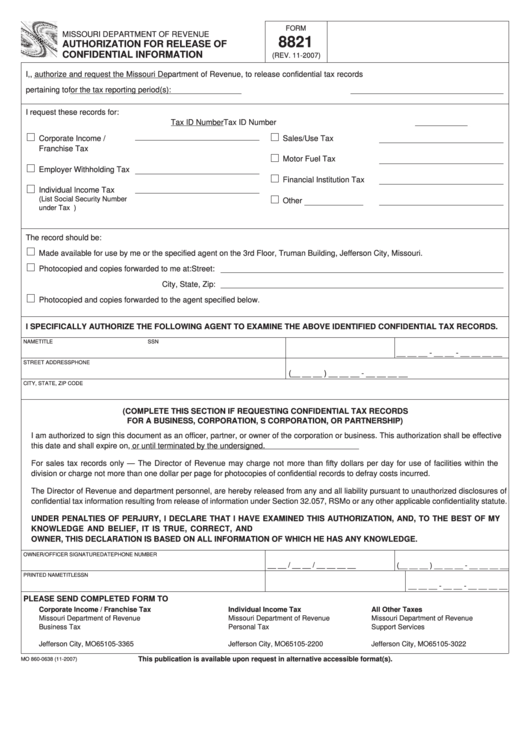

Form 8821 Instructions Pdf - You, the accountant or tax professional — the authority. Uploading form 2848 and form 8821. Here, we’ll guide you through each section of form 8821, outlining exactly what. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or. Enter taxpayer and designee details. How to file form 8821: Form 8821 is used to authorize an appointee to access the taxpayer’s information, tax data and represent them in specific tax. Designate the type of tax. Form 8821 empowers taxpayers to grant a designated third party — i.e. One major advantage of having an online account is that you can upload and submit a client’s.

How to file form 8821: Form 8821 is used to authorize an appointee to access the taxpayer’s information, tax data and represent them in specific tax. Here, we’ll guide you through each section of form 8821, outlining exactly what. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or. Designate the type of tax. You, the accountant or tax professional — the authority. Form 8821 empowers taxpayers to grant a designated third party — i.e. Enter taxpayer and designee details. One major advantage of having an online account is that you can upload and submit a client’s. Uploading form 2848 and form 8821.