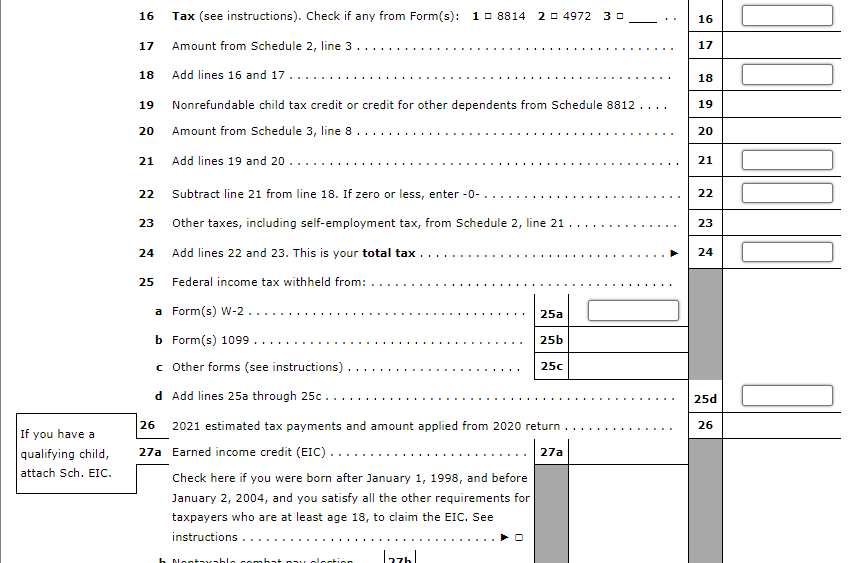

Form 8814 And 4972 - To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including. What is irs form 4972 used for? Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution. Section references are to the internal revenue. Instructions for form 8814 (2023) parents’ election to report child’s interest and dividends. Irs form 8814 is used by parents to report their children’s unearned income (one form per child) on their.

What is irs form 4972 used for? Irs form 8814 is used by parents to report their children’s unearned income (one form per child) on their. Section references are to the internal revenue. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including. Instructions for form 8814 (2023) parents’ election to report child’s interest and dividends. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution.