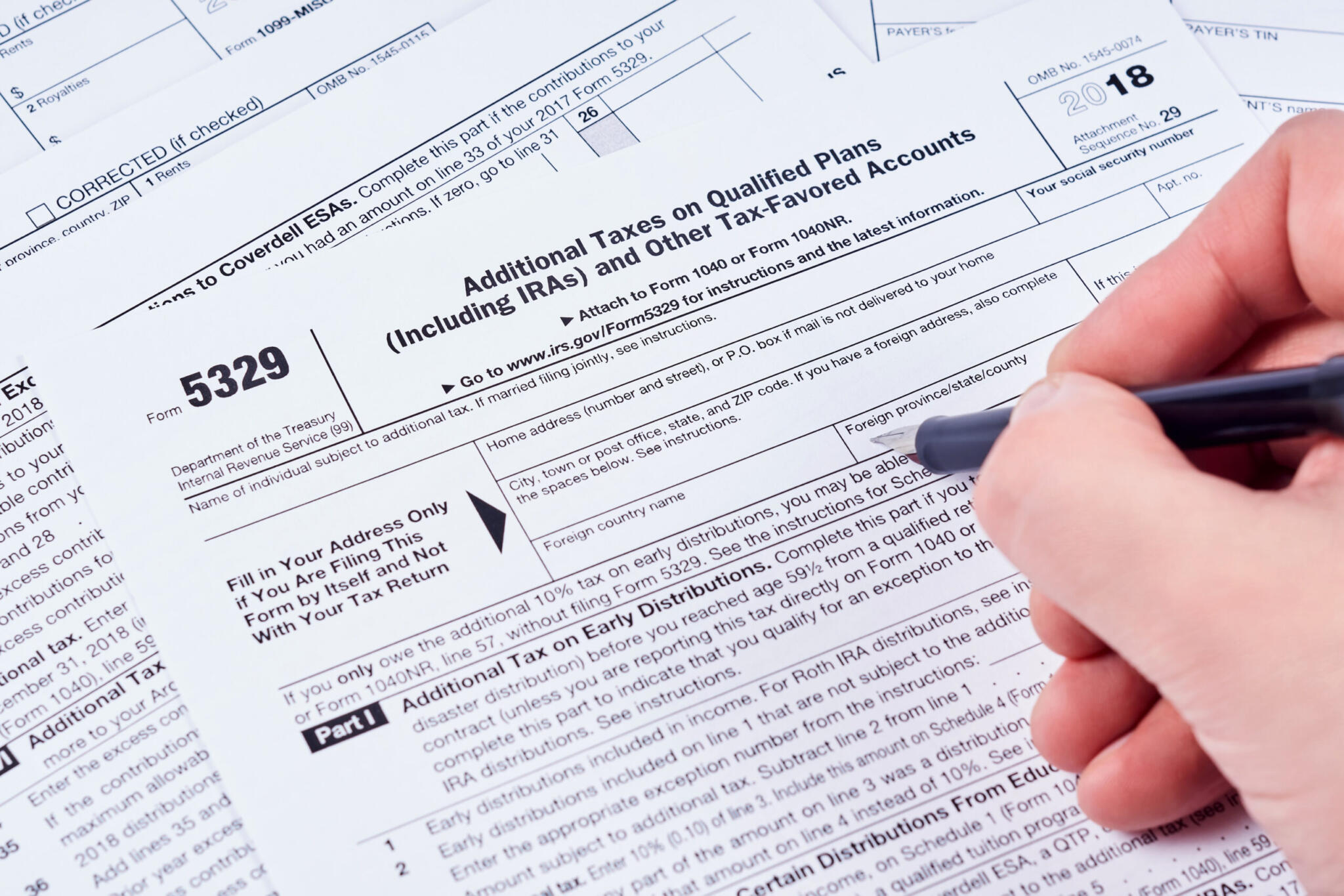

Can I File Form 5329 By Itself - Web if you file form 5329 by itself, then it can’t be filed electronically. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell. Web get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. From the input return tab, go to. Web how do i enter excess contributions on form 5329, line 15? Be sure to include your address on page 1 of the form and your.

Be sure to include your address on page 1 of the form and your. Web if you file form 5329 by itself, then it can’t be filed electronically. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell. Web get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Web how do i enter excess contributions on form 5329, line 15? From the input return tab, go to.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at10.46.34AM-28b5a363d4434af7be07ebd3d2b1e6b0.png)