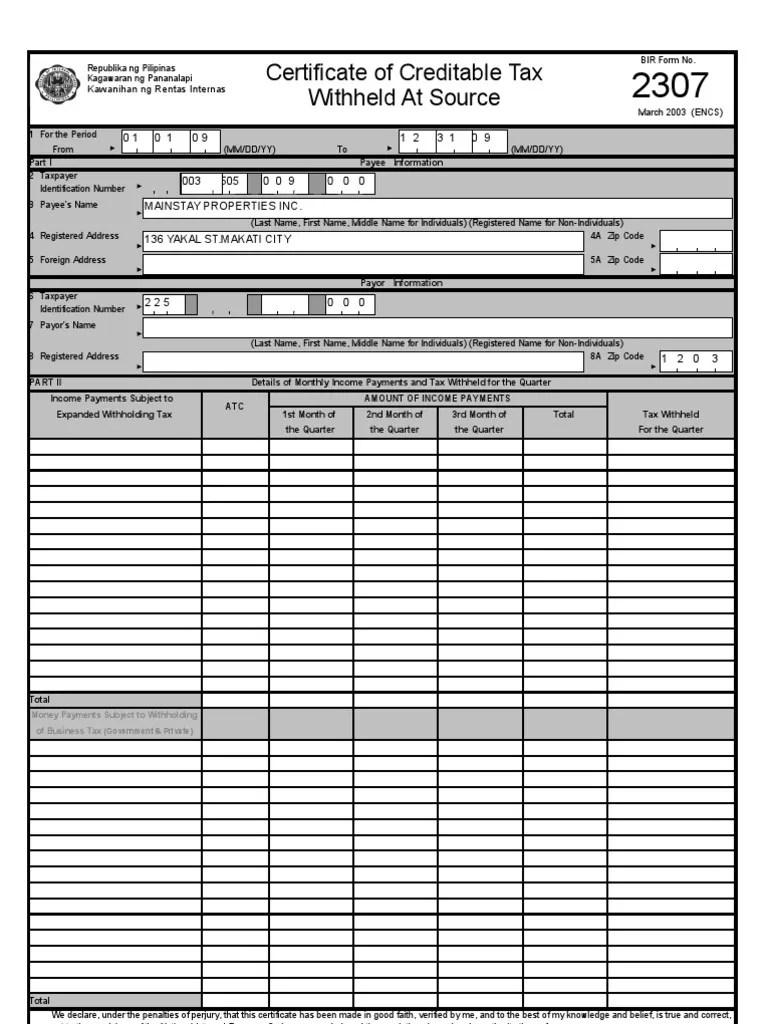

Bir Form 2307 - Capital gains tax return for onerous transfer of real property. Learn what bir form 2307 is, who needs to file it, and how to use it for tax computations in the philippines. Improperly accumulated earnings tax return for corporations. To be issued to payee on or before january 31 of the year following the year in which income payment was made. Certificate of income payment not subject to withholding tax (excluding compensation income) bir form. Learn what bir form 2307 is, who should fill it out, and how to use it as a withholding agent or a recipient.

Improperly accumulated earnings tax return for corporations. Capital gains tax return for onerous transfer of real property. To be issued to payee on or before january 31 of the year following the year in which income payment was made. Learn what bir form 2307 is, who needs to file it, and how to use it for tax computations in the philippines. Learn what bir form 2307 is, who should fill it out, and how to use it as a withholding agent or a recipient. Certificate of income payment not subject to withholding tax (excluding compensation income) bir form.