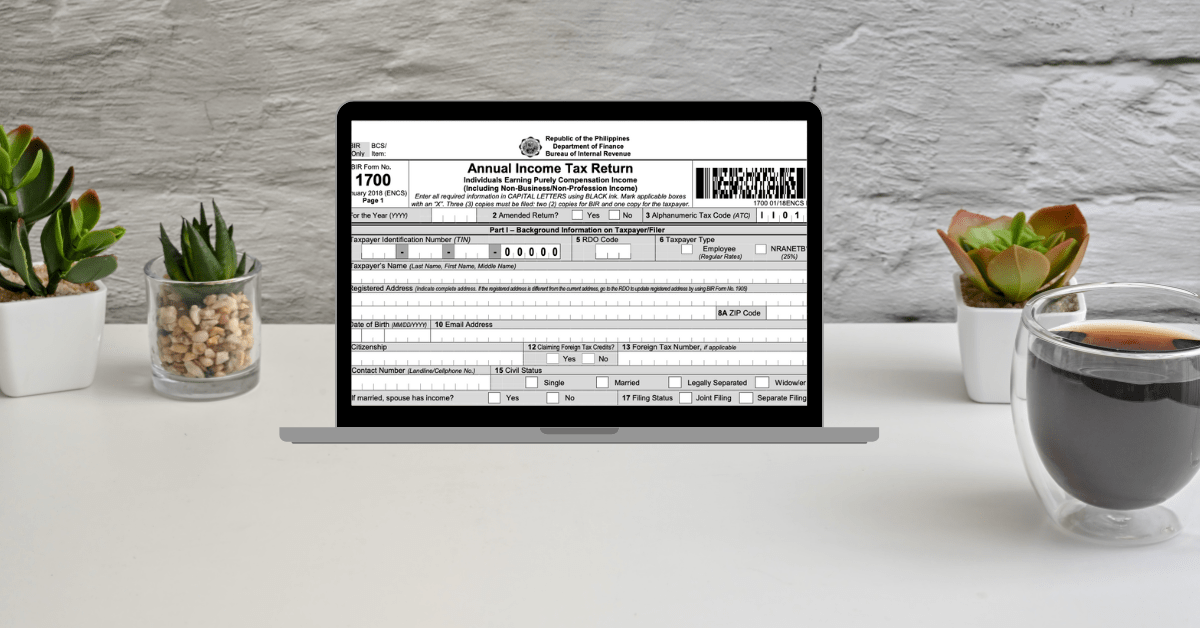

Bir Form 1700 - There are two methods in completing a tax form for submission in the efps: Web learn how to file your annual income tax return using form 1700, which is for employees with no other sources of. 1700 is for individuals earning purely compensation income from all sources, or from within the philippines. Web efps option page for form 1700.

1700 is for individuals earning purely compensation income from all sources, or from within the philippines. There are two methods in completing a tax form for submission in the efps: Web efps option page for form 1700. Web learn how to file your annual income tax return using form 1700, which is for employees with no other sources of.