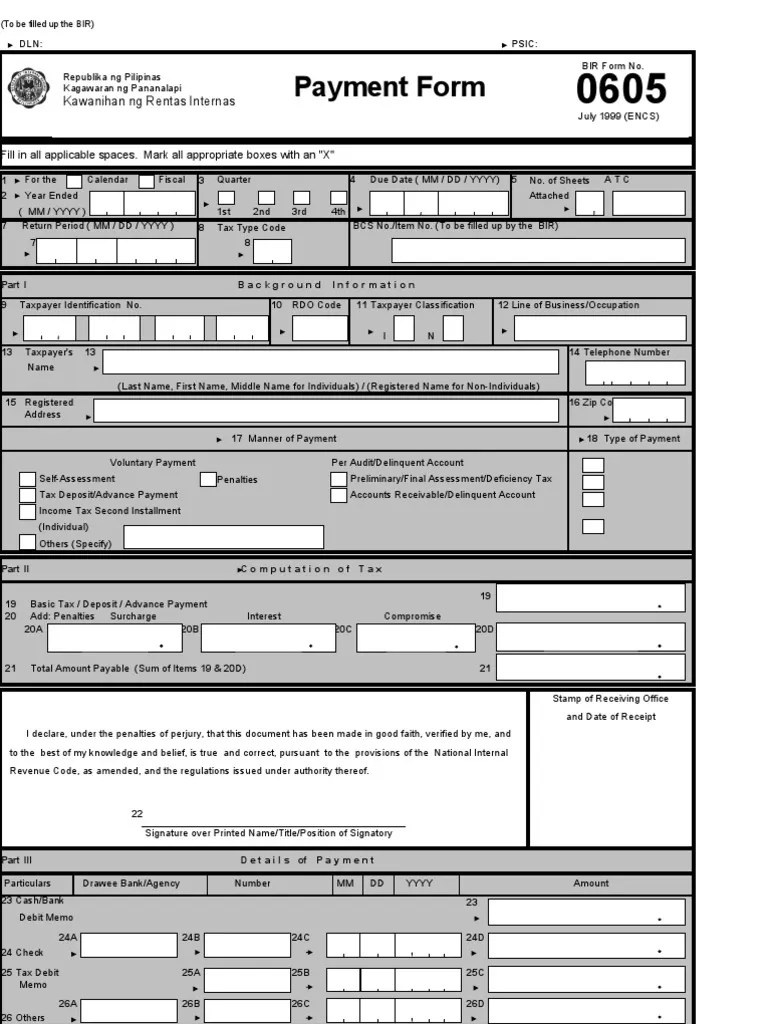

Bir Form 0605 - The bir form 0605 is. Efps option page for form 0605. Payment form covered by a letter notice: 0605 is used to pay taxes and fees that do not require a tax return, such as income tax, registration fees, penalties, etc. A step by step video guide that teaches you how to renew bir registration (form 0605) using ebir forms. Payment form under tax compliance verification drive/tax mapping: Every taxpayer shall use this form, in triplicate, to pay taxes and fees which do not require the use of a tax return such as second installment. There are two methods in completing a tax form for submission in the efps: September 2005 (encs) monthly remittance. July 1999 (encs) payment form.

0605 is used to pay taxes and fees that do not require a tax return, such as income tax, registration fees, penalties, etc. The bir form 0605 is. July 1999 (encs) payment form. A step by step video guide that teaches you how to renew bir registration (form 0605) using ebir forms. Payment form under tax compliance verification drive/tax mapping: Every taxpayer shall use this form, in triplicate, to pay taxes and fees which do not require the use of a tax return such as second installment. Efps option page for form 0605. September 2005 (encs) monthly remittance. There are two methods in completing a tax form for submission in the efps: Payment form covered by a letter notice: